The below list includes the Top 10 Public Wind Energy Companies sorted by Capacity (MW). This list was exported from the Renewables Platform inside of the Energy Acuity Product Suite and supported by Trading View & Morningstar.

NOTE: All performance numbers provided by Morningstar on Tuesday, Oct. 23, 2018, and do not include dividends. THIS IS NOT INVESTMENT ADVICE.

Top 10 Public Wind Energy Companies by Capacity (MW)

Companies include suppliers, developers, owners, and power purchasers.

1.) GE Energy (General Electric Energy)

| Wind Projects | Capacity (MW) | Ticker |

| 547 | 63,703.38 | GE |

General Electric Company (GE) is a global digital industrial company. The Company’s products and services range from aircraft engines, power generation, and oil and gas production equipment to medical imaging, financing, and industrial products. Its segments include Power, which includes products and services related to energy production; Renewable Energy, which offers renewable power sources; Oil & Gas, including liquefied natural gas and pipelines; Aviation, which includes commercial and military aircraft engines, and integrated digital components, among others; Healthcare, which provides healthcare technologies in medical imaging, digital solutions, patient monitoring and diagnostics, and drug discovery, among others; Transportation, which is a supplier to the railroad, mining, marine, stationary power and drilling industries; Energy Connections & Lighting, which includes Energy Connections and Lighting businesses, and Capital, which is a financial services division.

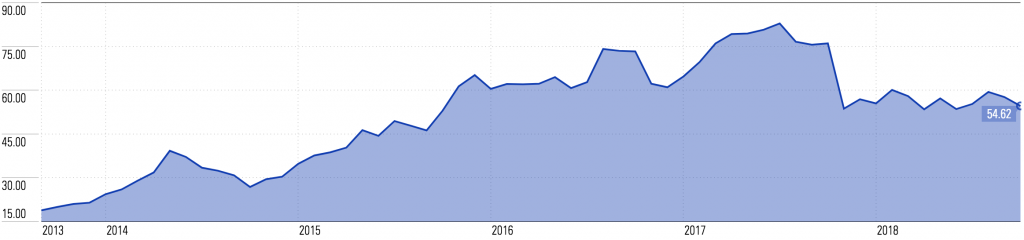

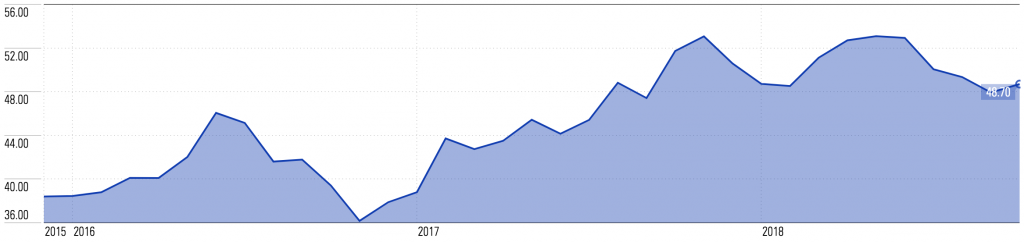

5-Yr GE Performance: -$11.51 USD | -48.18%

\

\

2.) Vestas

| Wind Projects | Capacity (MW) | Ticker |

| 389 | 35,636.71 | VWS |

Vestas Wind Systems A/S is a Denmark-based company active within the wind power industry. The Company operates through two segments, Project and Service. The Project segment is responsible for the sale of wind power plants and wind turbines, among others. The Service segment contains the provision of services related to the Company’s offer, as well as the sale of spare parts and other activities. Vestas Wind System’s product line comprises 2 Megawatt (MW) and 3MW energy capture platforms equipped with ice, smoke and shadow detection systems. Its services range consists of data-driven consultancy services, fleet optimization, blade maintenance and inspection, power generator repairs and gearbox exchange, among others.

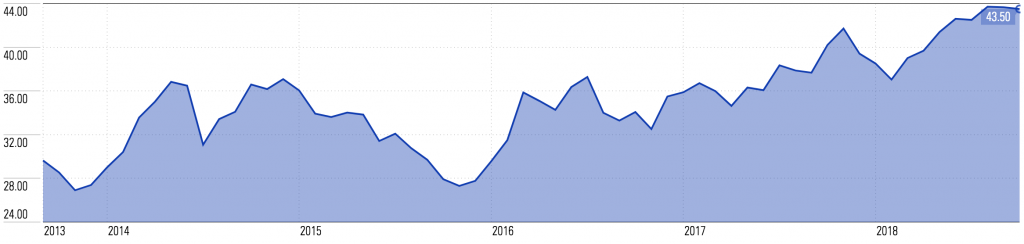

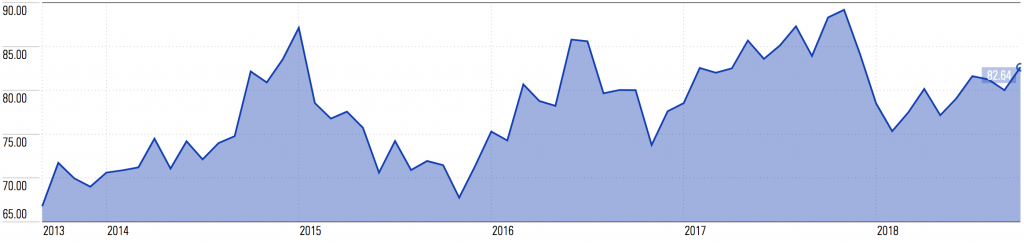

5-Yr Vestas Performance: +€35.78 DKK | +189.92%

3.) Exelon

| Wind Projects | Capacity (MW) | Ticker |

| 252 | 34,791.85 | EXC |

Exelon Corporation (EXC) is a utility services holding company. The Company, through its subsidiary, Exelon Generation Company, LLC (Generation), is engaged in the energy generation business. The Company, through its subsidiaries, Commonwealth Edison Company (ComEd), PECO Energy Company (PECO), Baltimore Gas and Electric Company (BGE), Pepco Holdings LLC (PHI), Potomac Electric Power Company (Pepco), Delmarva Power & Light Company (DPL) and Atlantic City Electric Company (ACE), is engaged in the energy delivery businesses. It operates through 12 segments: Generation’s six segments: Mid-Atlantic, Midwest, New England, New York, ERCOT and Other Power Regions; ComEd; PECO; BGE, and PHI’s three utility segments: Pepco, DPL and ACE. Generation’s integrated business consists of the generation, physical delivery and marketing of power across geographical regions through its customer-facing business, Constellation, which sells electricity and natural gas to both wholesale and retail customers.

5-Yr Exelon Performance: +$13.86 USD | +46.76%

4.) Siemens

| Wind Projects | Capacity (MW) | Ticker |

| 212 | 28,562.90 | SIE |

Siemens AG is a Germany-based technology company with activities in the fields of electrification, automation and digitalization. It is also a supplier of systems for power generation and transmission, as well as medical diagnosis. It operates through nine segments: Power and Gas; Wind Power and Renewables; Energy Management; Building Technologies; Mobility; Digital Factory; Process Industries and Drives; Healthineers, and Financial Services. The Company’s product groups include automation, building technologies, drive technology, healthcare, mobility, energy, financing, consumer products and services. Its services include industry services, energy services, healthcare services, rail and road solutions services, logistics and airport solutions services, home appliances services, and building technologies services. Its market-specific solutions are focused on markets, such as aerospace, automotive, data centers, fiber industry, food and beverage, and machinery and plant construction.

5-Yr Siemens Performance: +€11.18 EUR | +12.55%

5.) NextEra Energy Inc.

| Wind Projects | Capacity (MW) | Ticker |

| 172 | 26,395.98 | NEE |

NextEra Energy, Inc. (NEE) is a holding company. The Company is an electric power companies in North America and, through its subsidiary NextEra Energy Resources, LLC (NEER) and its affiliated entities, is the generator of renewable energy from the wind and sun. NEE also owns and/or operates generation, transmission and distribution facilities to support its services to retail and wholesale customers, and has investments in gas infrastructure assets. Its segments include FPL and NEER. Florida Power & Light Company (FPL) is a rate-regulated electric utility engaged primarily in the generation, transmission, distribution and sale of electric energy in Florida. NEER is a diversified clean energy company with a business strategy that emphasizes the development, acquisition and operation of long-term contracted assets with a focus on renewable projects. NEER owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets.

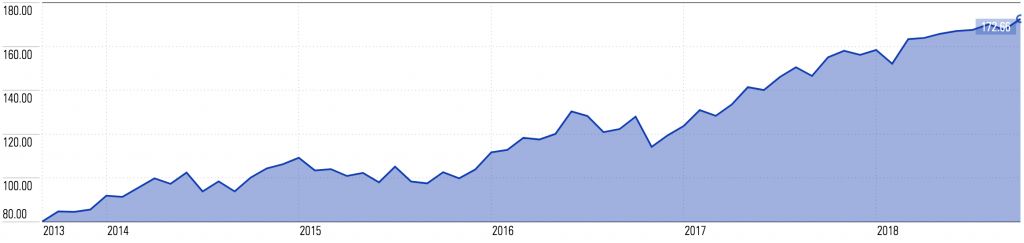

5-Yr NextEra Energy Performance: +$92.50 USD | +115.39%

6.) American Electric Power

| Wind Projects | Capacity (MW) | Ticker |

| 108 | 23,232.31 | AEP |

American Electric Power Company, Inc. (AEP) is a public utility holding company that owns, directly or indirectly, all of the outstanding common stock of its public utility subsidiaries and varying percentages of other subsidiaries. The service areas of the Company’s public utility subsidiaries cover the states of Arkansas, Indiana, Kentucky, Louisiana, Michigan, Ohio, Oklahoma, Tennessee, Texas, Virginia and West Virginia. The Company’s segments include Vertically Integrated Utilities, Transmission and Distribution Utilities, AEP Transmission Holdco, and Generation & Marketing. AEP’s vertically integrated utility operations are engaged in the generation, transmission and distribution of electricity for sale to retail and wholesale customers. Transmission and Distribution Utilities segment consists of the transmission and distribution of electricity for sale to retail and wholesale customers. AEP Transmission Holdco develops, constructs and operates transmission facilities.

5-Yr AEP Performance: +$29.80 USD | +68.74%

7.) Xcel Energy

| Wind Projects | Capacity (MW) | Ticker |

| 219 | 23,050.55 | XEL |

Xcel Energy Inc. (XEL) is a public utility holding company. The Company’s operations include the activity of four utility subsidiaries that serve electric and natural gas customers in eight states. The Company’s segments include regulated electric utility, regulated natural gas utility and all other. The Company’s utility subsidiaries include NSP-Minnesota, NSP-Wisconsin, Public Service Company of Colorado (PSCo) and Southwestern Public Service Co. (SPS), which serve customers in portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas and Wisconsin. Along with WYCO Development LLC (WYCO), a joint venture formed with Colorado Interstate Gas Company, LLC (CIG) to develop and lease natural gas pipelines storage and compression facilities, and WestGas InterState, Inc. (WGI), an interstate natural gas pipeline company, these companies comprise the regulated utility operations.

5-Yr Xcel Performance: Not Currently Available

8.) Avangrid Renewables

| Wind Projects | Capacity (MW) | Ticker |

| 121 | 16,871.78 | AGR |

Avangrid, Inc. (AGR) is a renewable energy and utility company. The Company operates through two segments: Networks and Renewables. The Networks segment includes all the energy transmission and distribution activities, and any other regulated activity originating in New York and Maine, and regulated electric distribution, electric transmission and gas distribution activities originating in Connecticut and Massachusetts. The Renewables segment owns, develops, constructs and operates electricity generation, including renewable and thermal generators, and associated transmission facilities. The Renewables segment includes activities relating to renewable energy, mainly wind energy generation and trading related with such activities.

5-Yr Avangrid Performance: +$10.30 USD | +26.82%

9.) Ameren

| Wind Projects | Capacity (MW) | Ticker |

| 58 | 10,974.45 | AEE |

Ameren Corporation (AEE) is a utility holding company. The Company’s subsidiaries include Ameren Missouri, Ameren Illinois and Ameren Transmission Company (ATXI). It operates through four segments. The Ameren Missouri segment includes all of the operations of Ameren Missouri. The Ameren Illinois Electric Distribution segment consists of the electric distribution business of Ameren Illinois. The Ameren Illinois Natural Gas segment consists of the natural gas business of Ameren Illinois. The ATXI segment consists of the aggregated electric transmission businesses of Ameren Illinois and ATXI. Ameren Missouri operates a rate-regulated electric generation, transmission, and distribution business and a rate-regulated natural gas distribution business in Missouri. Ameren Illinois operates rate-regulated electric distribution, electric transmission and natural gas distribution businesses in Illinois. ATXI operates a Federal Energy Regulatory Commission rate-regulated electric transmission business.

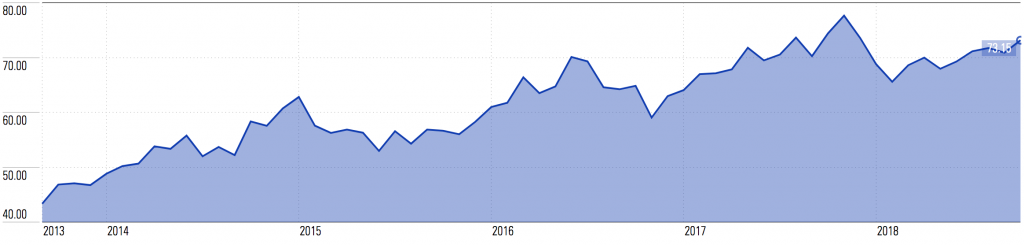

5-Yr Ameren Performance: +$30.81 USD | +88.43%

10.) Duke Energy

| Wind Projects | Capacity (MW) | Ticker |

| 55 | 10,040.30 | DUK |

Duke Energy Corporation (DUK) is an energy company. The Company operates through three segments: Electric Utilities and Infrastructure; Gas Utilities and Infrastructure, and Commercial Renewables. The Company operates in the United States through its direct and indirect subsidiaries. The Electric Utilities and Infrastructure segment provides retail electric service through the generation, transmission, distribution and sale of electricity to approximately 7.5 million customers within the Southeast and Midwest regions of the United States. The operations include electricity sold wholesale to municipalities, electric cooperative utilities and other load-serving entities. The Gas Utilities and Infrastructure segment serves residential, commercial, industrial and power generation natural gas customers. The Commercial Renewables primarily acquires, builds, develops and operates wind and solar renewable generation throughout the continental United States.

5-Yr Duke Energy Performance: +$15.86 USD | +23.75%

NOTE: All performance numbers provided by Morningstar on Tuesday, Oct. 23, 2018, and do not include dividends. THIS IS NOT INVESTMENT ADVICE.

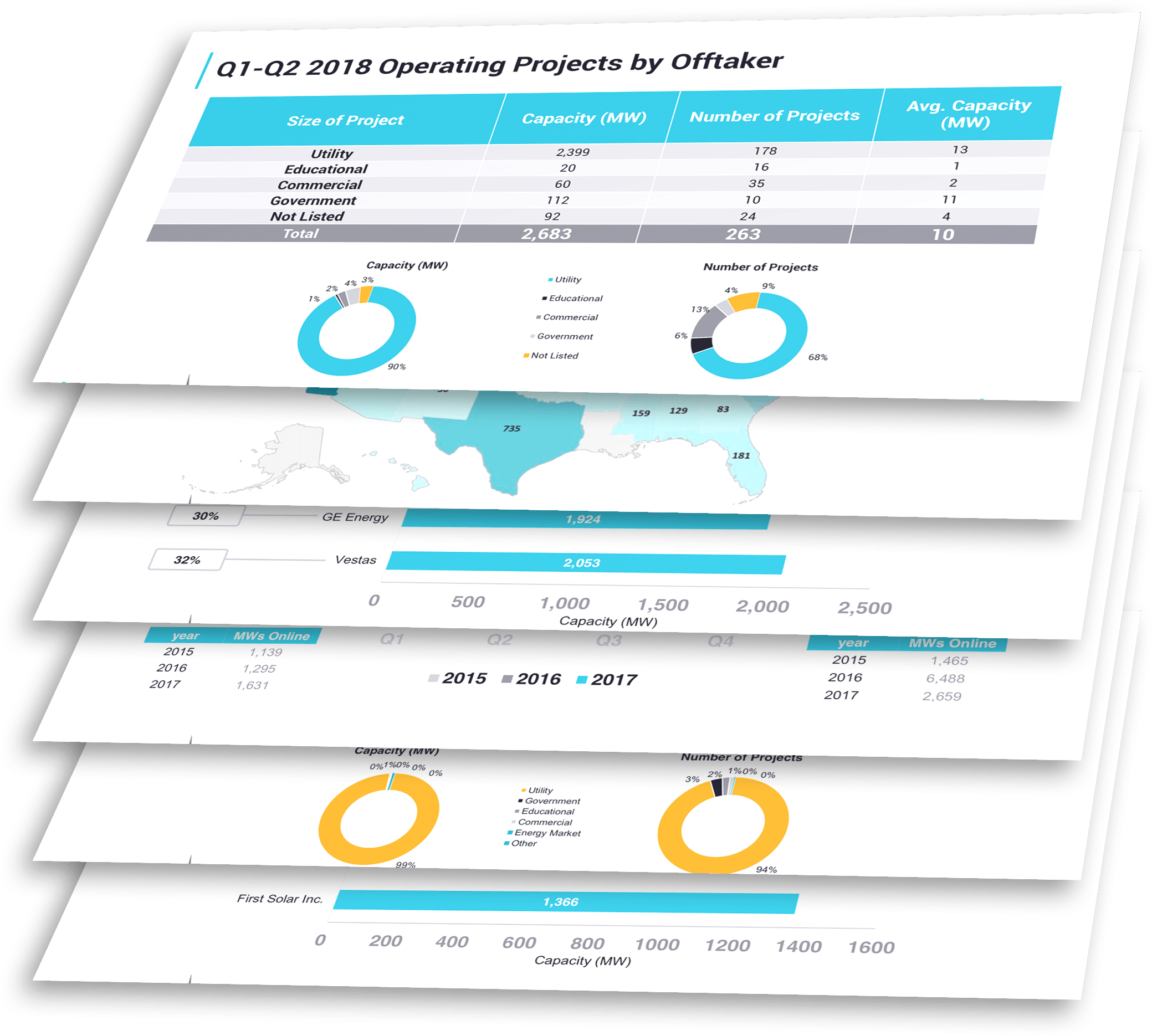

Source: Energy Acuity, Trading View, Morningstar

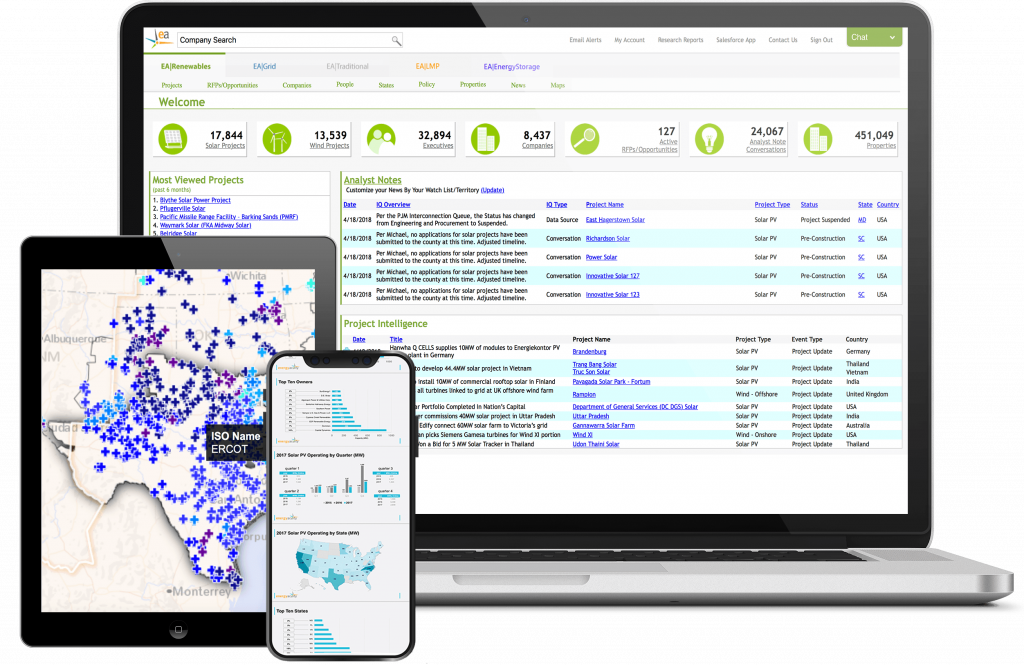

Need Detailed Renewable Energy Information & Analysis? Request a Free Demo of the Energy Acuity Platform Today!

Energy Acuity (EA) is the leading provider of power generation and power delivery market intelligence. EA’s unique approach merges primary research, public resource aggregation, web monitoring and expert analysis that is delivered through a simple, dynamic online platform. This allows our clients to focus on actionable information and win business over the competition! Experience the difference today!

Thank you for the information! Clearly explained and an overall really good list! Thank you again