The below list includes the Top 10 Public Solar Energy Companies sorted by Owned U.S. Capacity (MW). This list was exported from the Renewables Platform inside of the Energy Acuity Product Suite and supported by Trading View & Morningstar.

NOTE: All performance numbers provided by Morningstar on Tuesday, Oct. 23, 2018, and do not include dividends. THIS IS NOT INVESTMENT ADVICE.

Top 10 Public Solar Energy Companies by Owned U.S. Capacity (MW)

1.) First Solar

| Projects | Capacity | Ticker |

| 23 | 2686.484 | FSLR |

First Solar, Inc. (FSLR) is a provider of photovoltaic (PV) solar energy solutions. The Company designs, manufactures and sells PV solar modules with a thin-film semiconductor technology. The Company also develops, designs, constructs and sells PV solar power systems that primarily use the modules it manufactures. It operates through two segments: components and systems. The components segment is engaged in the design, manufacture and sale of cadmium telluride (CdTe) solar modules, which convert sunlight into electricity. The systems segment includes the development, construction, operation and maintenance of PV solar power systems, which primarily use its solar modules. In addition, the Company provides operations and maintenance (O&M) services to system owners that use solar modules manufactured by it or by third-party manufacturers. The Company’s solar modules had an average rated power per module of approximately 114 watts, as of December 31, 2016.

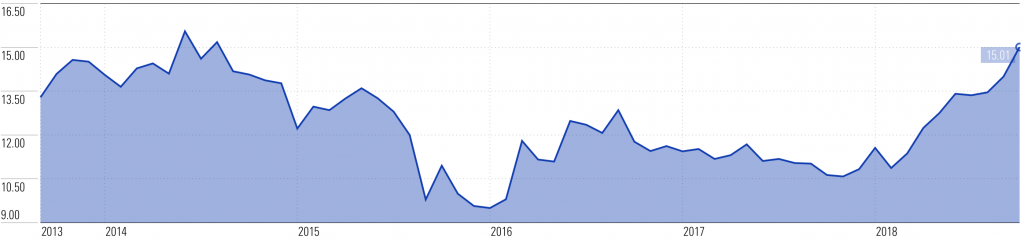

5-Yr First Solar Performance: No Morningstar Data Available

2.) Southern Power

| Projects | Capacity | Ticker |

| 30 | 2483.466 | SO |

The Southern Company (Southern Company) is a holding company. The Company owns all of the stock of the traditional electric operating companies and the parent entities of Southern Power Company (Southern Power) and Southern Company Gas, and owns other direct and indirect subsidiaries. The Company’s segments include Gas distribution operations, Gas marketing services, Wholesale gas services, Gas midstream operations and All other. The Gas distribution operations segment includes natural gas local distribution utilities that construct, manage, and maintain intrastate natural gas pipelines and gas distribution facilities in seven states. The Gas marketing services segment provides natural gas commodity and related services to customers markets that provide for customer choice. The Wholesale gas services segment engages in natural gas storage and gas pipeline arbitrage. The Gas midstream operations consist primarily of gas pipeline investments, with storage and fuels.

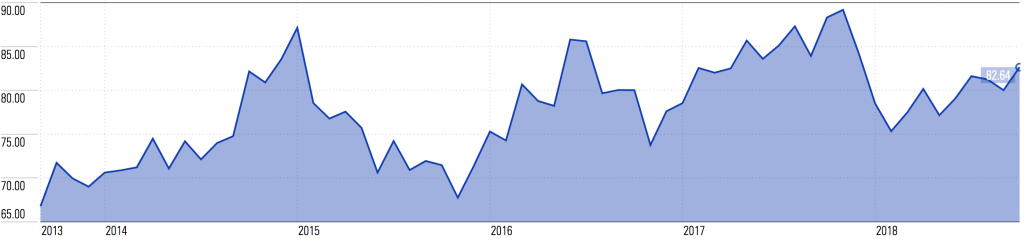

5-Yr Southern Power Performance: +$3.79 USD | +9.20%

3.) NRG Energy

| Projects | Capacity | Ticker |

| 85 | 2355.136 | NRG |

NRG Energy, Inc. (NRG), is an integrated power company. The Company is engaged in producing, selling and delivering electricity and related products and services in various markets in the United States. The Company’s segments include Generation, Retail and Corporate activities. The Generation segment includes generation and international. The Retail segment includes Mass customers and Business Solutions. Its Business Solutions include commercial, industrial and governmental/institutional (C&I) customers, and other distributed and reliability products. The corporate activities segment includes residential solar and electric vehicle services.

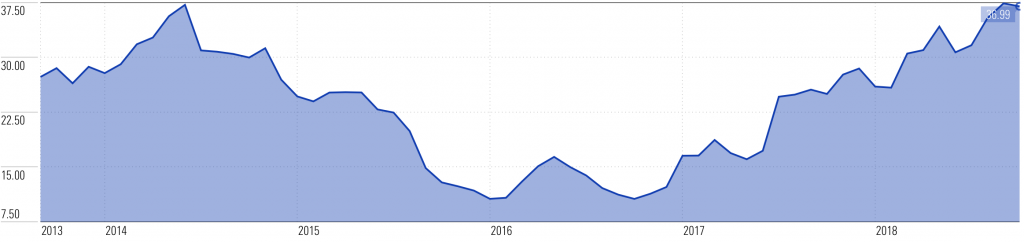

5-Yr NRG Energy Performance: +$9.66 USD | +35.35%

4.) NextEra Energy

| Projects | Capacity | Ticker |

| 30 | 2091.548 | NEE |

NextEra Energy, Inc. (NEE) is a holding company. The Company is an electric power companies in North America and, through its subsidiary NextEra Energy Resources, LLC (NEER) and its affiliated entities, is the generator of renewable energy from the wind and sun. NEE also owns and/or operates generation, transmission and distribution facilities to support its services to retail and wholesale customers, and has investments in gas infrastructure assets. Its segments include FPL and NEER. Florida Power & Light Company (FPL) is a rate-regulated electric utility engaged primarily in the generation, transmission, distribution and sale of electric energy in Florida. NEER is a diversified clean energy company with a business strategy that emphasizes the development, acquisition and operation of long-term contracted assets with a focus on renewable projects. NEER owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets.

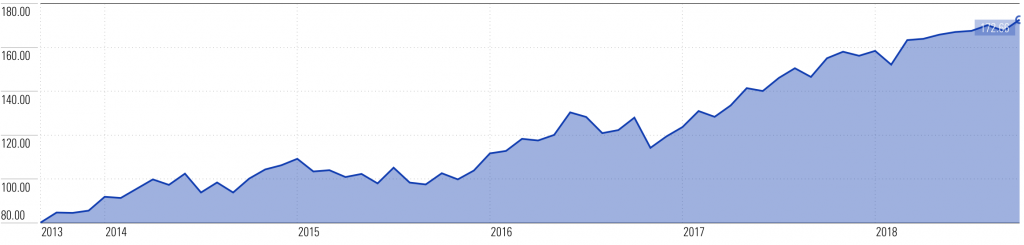

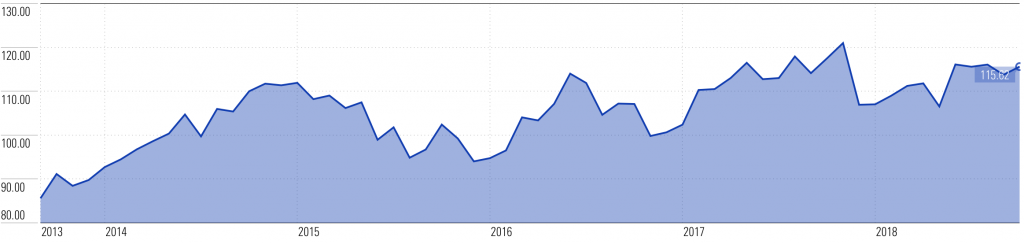

5-Yr NextEra Performance: +$92.50 USD | +115.39%

5.) Dominion

| Projects | Capacity | Ticker |

| 53 | 1886.255 | D |

Dominion Energy, Inc. (D), formerly Dominion Resources, Inc., is a producer and transporter of energy. Dominion is focused on its investment in regulated electric generation, transmission and distribution and regulated natural gas transmission and distribution infrastructure. It operates through three segments: Dominion Virginia Power operating segment (DVP), Dominion Generation, Dominion Energy, and Corporate and Other. The DVP segment includes regulated electric distribution and regulated electric transmission. The Dominion Generation segment includes regulated electric fleet and merchant electric fleet. The Dominion Energy segment includes gas transmission and storage, gas gathering and processing, liquefied natural gas import and storage, and nonregulated retail energy marketing. As of December 31, 2016, Dominion served utility and retail energy customers, and operated an underground natural gas storage system with approximately one trillion cubic feet of storage capacity.

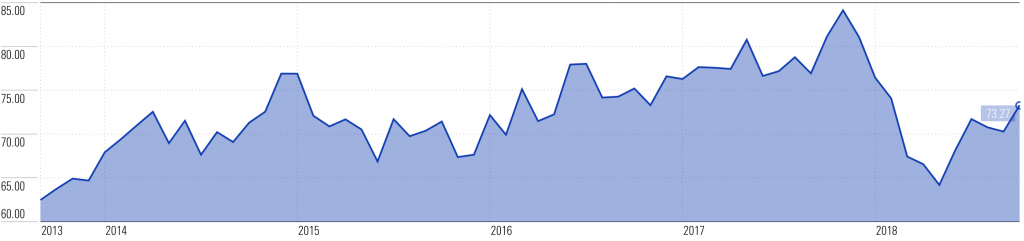

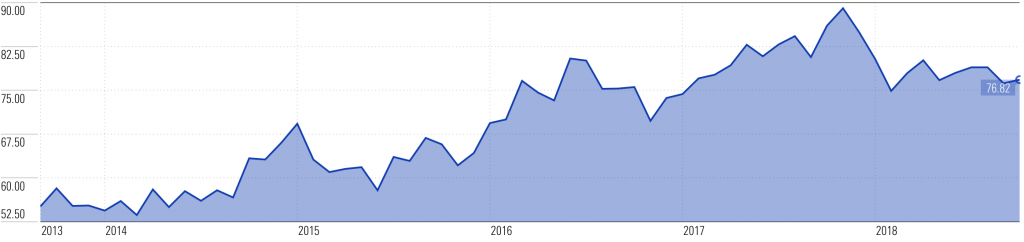

5-Yr Dominion Performance: +$10.79 USD | +17.27%

6.) AES Corporation

| Projects | Capacity | Ticker |

| 55 | 1618.045 | AES |

The AES Corporation (AES) is a holding company. The Company, through its subsidiaries and affiliates, operates a diversified portfolio of electricity generation and distribution businesses. It is organized into six strategic business units (SBUs): the United States; Andes; Brazil; Mexico, Central America and the Caribbean (MCAC); Europe, and Asia. As of December 31, 2016, its United States SBU had 18 generation facilities and two integrated utilities in the United States. As of December 31, 2016, its Andes SBU had generation facilities in three countries. Its Brazil SBU has generation and distribution businesses, Eletropaulo and Tiete. As of December 31, 2016, its MCAC SBU had a portfolio of distribution businesses and generation facilities, including renewable energy, in five countries. As of December 31, 2016, its Europe SBU had generation facilities in five countries. As of December 31, 2016, its Asia SBU had generation facilities in three countries.

5-Yr AES Performance: +$1.72 USD | +12.94%

7.) SunPower

| Projects | Capacity | Ticker |

| 57 | 1201.886 | SPWR |

SunPower Corporation (SPWR) is a global energy company. The Company delivers complete solar solutions to residential, commercial, and power plant customers. The Company’s segments include Residential Segment, Commercial Segment and Power Plant Segment. The Residential and Commercial Segments combined are referred to as Distributed Generation. The Company offers solar module technology and solar power systems that are designed to generate electricity over a system life over 25 years; Integrated Smart Energy software solutions that enable customers to manage and optimize the cooperation center of excellence (CCOE) measurement; Installation, construction, and ongoing maintenance and monitoring services; and financing solutions that provide customers a range of options for purchasing or leasing solar products at competitive energy rates. The Company offers a set of residential solutions that deliver value to homeowners and its dealer partners.

5-Yr SunPower Performance: No Morningstar Data Available

8.) Consolidated Edison (Con Edison)

| Projects | Capacity | Ticker |

| 10 | 1137.899 | ED |

Consolidated Edison, Inc. (Con Edison) is a holding company. The Company operates through its subsidiaries, which include Consolidated Edison Company of New York, Inc. (CECONY), Orange and Rockland Utilities, Inc. (O&R), Con Edison Clean Energy Businesses, Inc. (the Clean Energy Businesses) and Con Edison Transmission, Inc. (Con Edison Transmission). CECONY’s principal business operations are its regulated electric, gas and steam delivery businesses. CECONY provides electricity, natural gas and steam to customers in New York City and Westchester County. O&R’s principal business operations are its regulated electric and gas delivery businesses. The Clean Energy Businesses develop, own and operate renewable and energy infrastructure projects and provide energy-related products and services to wholesale and retail customers. Con Edison Transmission, through its subsidiaries, invests in electric transmission facilities and gas pipeline and storage facilities.

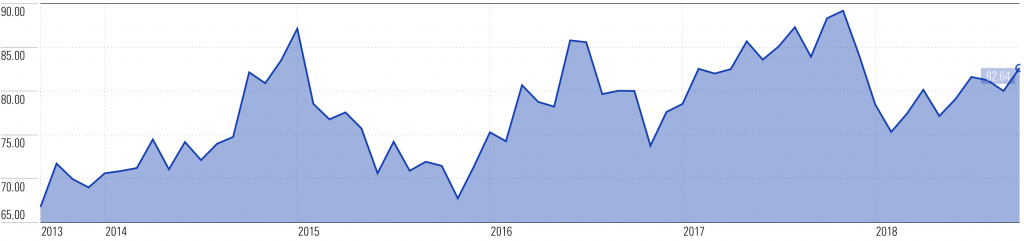

5-Yr ConEd Performance: +$21.68 USD | +39.32%

9.) Duke Energy

| Projects | Capacity | Ticker |

| 54 | 638.825 | DUK |

Duke Energy Corporation (DUK) is an energy company. The Company operates through three segments: Electric Utilities and Infrastructure; Gas Utilities and Infrastructure, and Commercial Renewables. The Company operates in the United States through its direct and indirect subsidiaries. The Electric Utilities and Infrastructure segment provides retail electric service through the generation, transmission, distribution and sale of electricity to approximately 7.5 million customers within the Southeast and Midwest regions of the United States. The operations include electricity sold wholesale to municipalities, electric cooperative utilities and other load-serving entities. The Gas Utilities and Infrastructure segment serves residential, commercial, industrial and power generation natural gas customers. The Commercial Renewables primarily acquires, builds, develops and operates wind and solar renewable generation throughout the continental United States.

5-Yr Duke Performance: +$15.86 USD | +23.75%

10.) Sempra Energy

| Projects | Capacity | Ticker |

| 7 | 579.900 | SRE |

Sempra Energy (SRE) is a holding company. The Company’s principal operating units are Sempra Utilities, which includes its San Diego Gas & Electric Company (SDG&E), Southern California Gas Company (SoCalGas) and Sempra South American Utilities segments, and Sempra Infrastructure, which includes its Sempra Mexico, Sempra Renewables and Sempra LNG & Midstream segments. As of December 31, 2016, SDG&E’s service area covered 4,100 square miles. Sempra South American Utilities operates Chilquinta Energia, which serves customers in the region of Valparaiso in central Chile. As of December 31, 2016, SoCalGas had natural gas franchises with the 12 counties and the 223 cities in its service territory. Sempra LNG & Midstream owns land in Simpson County, Mississippi Hub. Sempra LNG & Midstream owns land in Port Arthur, Texas. Sempra Renewables has operations, investments or development projects in the various United States markets.

5-Yr Sempra Energy Performance: +$30.02 USD | +35.07%

NOTE: All performance numbers provided by Morningstar on Tuesday, Oct. 23, 2018, and do not include dividends. THIS IS NOT INVESTMENT ADVICE.

Source: Energy Acuity, Trading View, Morningstar

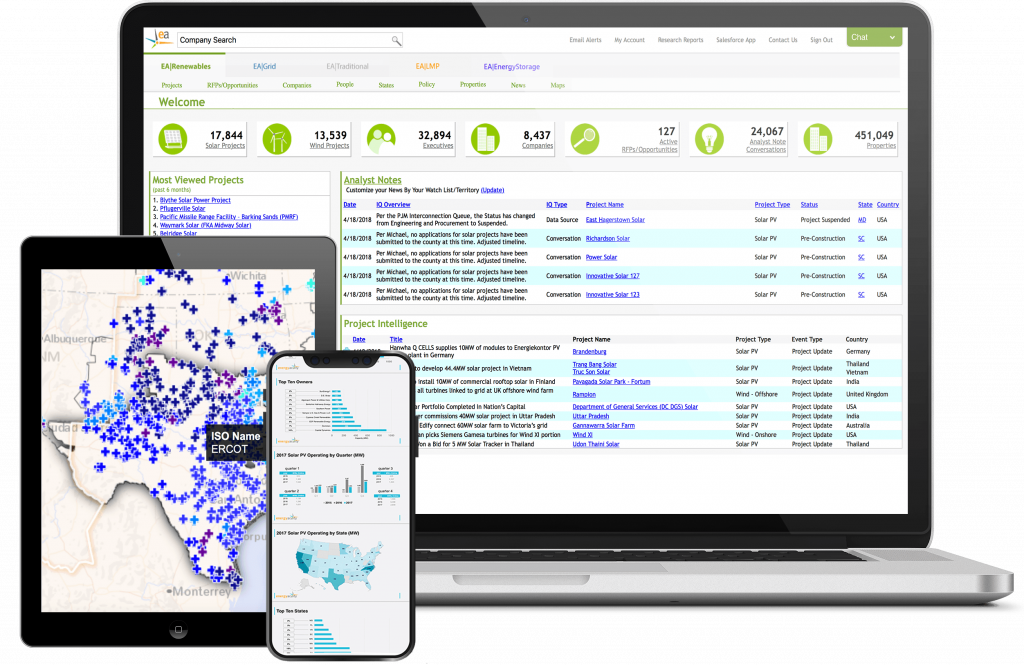

Need Detailed Renewable Energy Information & Analysis? Request a Free Demo of the Energy Acuity Platform Today!

Energy Acuity (EA) is the leading provider of power generation and power delivery market intelligence. EA’s unique approach merges primary research, public resource aggregation, web monitoring and expert analysis that is delivered through a simple, dynamic online platform. This allows our clients to focus on actionable information and win business over the competition! Experience the difference today!

We are looking for this types of pump product for a project, submissive solar water-powered pump Part:Number 95027335. Note: We would like to know the lead time on this item so we can also have this item picked up or shipped to our project locations. Thanks!