Compare your current business development & research process with how easy it could be with Energy Acuity. Is it worth the 10-15 minutes to see if EA is a good fit?

Solar Project Searching Tracking & Analysis Video

How to quickly and efficiently target solar projects that are perfect for your business!

Solar Project Transcript & Screenshots

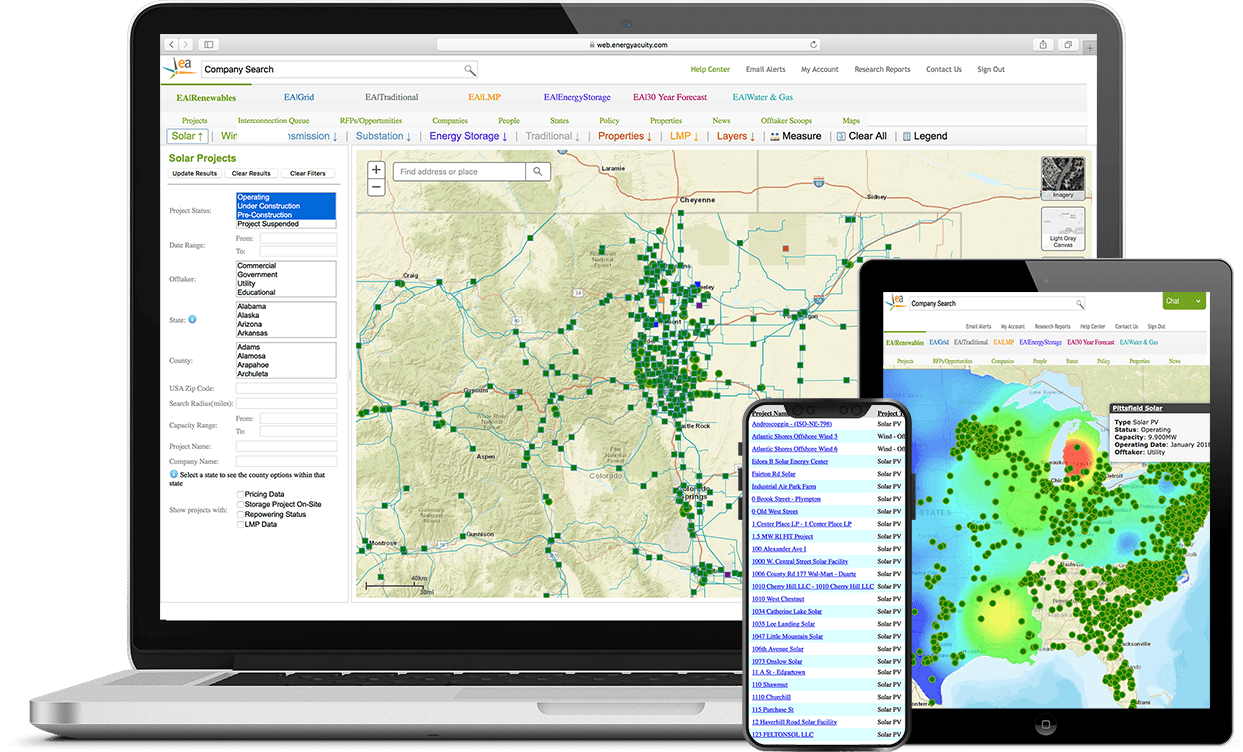

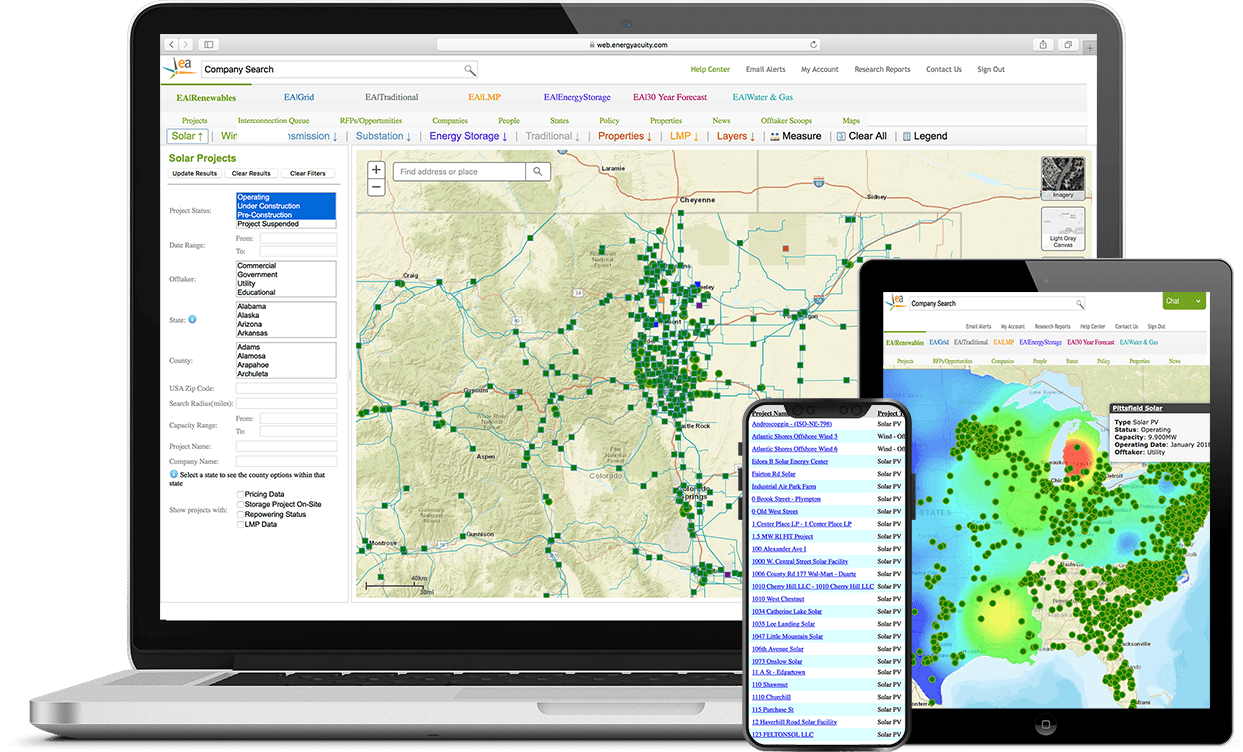

Hi everyone! Greg here with Energy Acuity and today we’re going to be focusing on solar projects and how to analyze your target market. We’ll go through solar project searching, tracking, analysis as well as some advanced mapping features associated with energy acuity’s solar project search.

We know that finding early-stage projects can sometimes be difficult because the information is spread across multiple sources, platforms, ISO /RTOs, and each of these different geological regions’ present different challenges due to the diverse data sources as well as the differing levels of transparency in each source.

For most solar professionals, this makes it hard to analyze the solar projects in their target market and it can be extremely time consuming and inefficient. With energy acuity, you can cut this research time down by around 90% when analyzing your target market to find projects that perfectly fit your use cases.

We do this by aggregating regulatory and permitting filings, exclusive sources, affiliate pipelines, as well as proprietary research methodology from a team of in-house analysts

Let’s go ahead and dive in and see why Energy Acuity has the most comprehensive solar project searching in the industry!

Solar Project Searching

Hi, I’m Kurt from the Energy Acuity sales team. We wanted to take a deeper look at how we’re actually researching solar projects and how you can search for these solar projects.

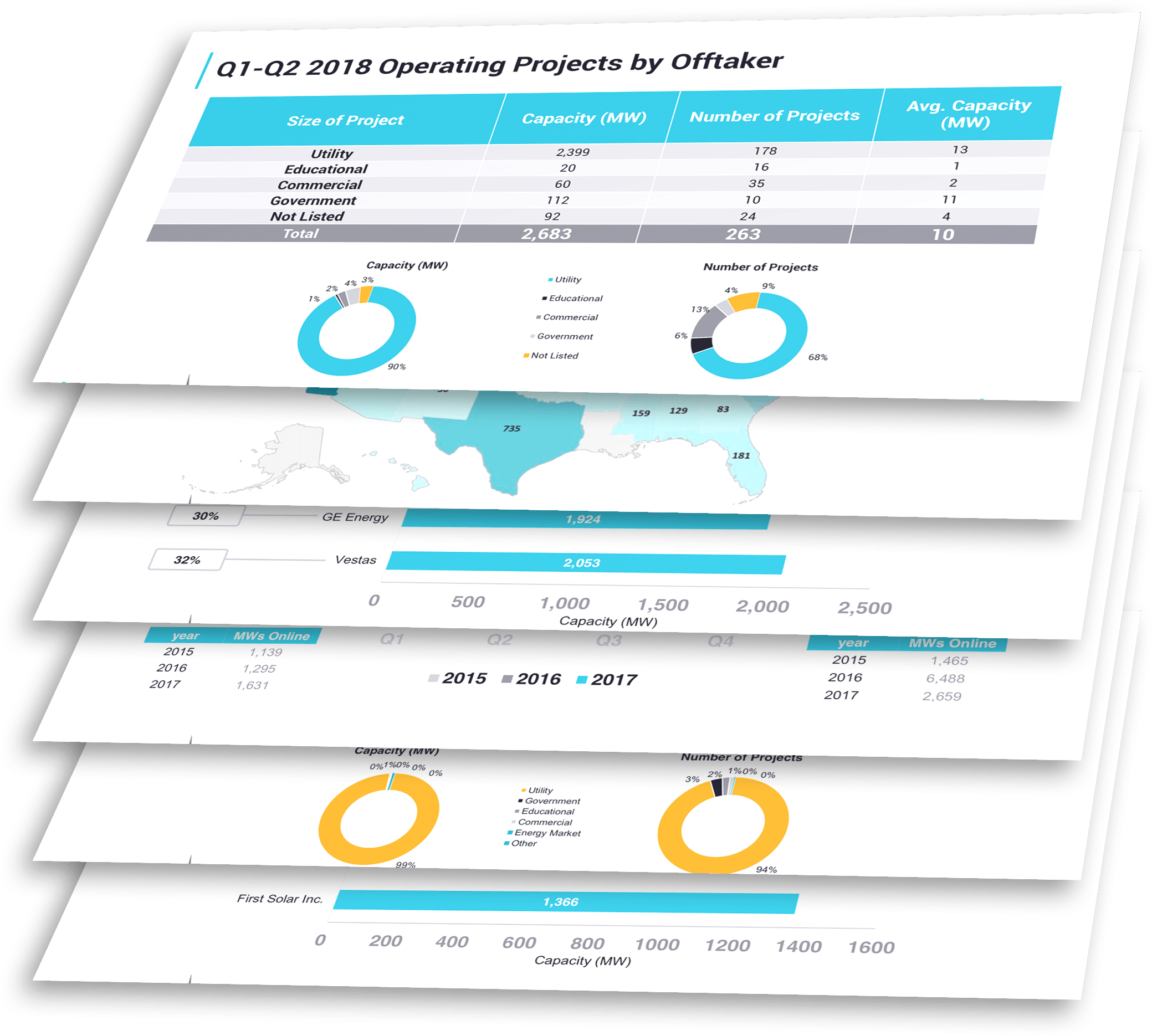

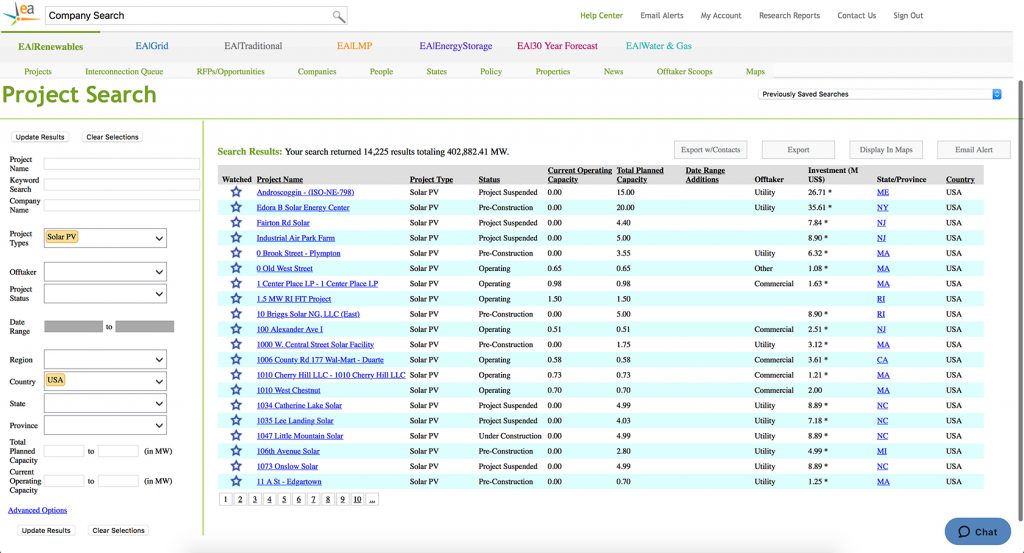

The screen you’re looking at right now is displaying about a thousand results. Let’s narrow this down to the topic of choice being solar PV in the U.S… You have about 14,000 results spanning all statuses. Starting from pre-construction, all the way through operating, and also tracking suspended projects – for those that are looking for easy acquisitions.

Today, we’ll focus on pre-construction projects within the US.

You have the ability to narrow down your search by project name, keyword, company, type, offtaker, status, state, and capacity, as well as some Advanced Options like ISO region, whether or not these projects have Power Purchase Agreements (PPA) in place, what the investment range might be and projects with or without Storage Projects On-site, Repowering Status and/or LMP data – which is an ancillary service offered by energy acuity.

Let’s take a look at some simple searching… Let’s look at pre-construction projects in Virginia, out in PJM.

Here at Energy Acuity, we understand that you can’t get a good grasp on the industry if you don’t start at the project level and for that reason, we have accurate and granular details, all captured through federally regulated documents, publicly available documents, news articles as well as our analyst team here in Denver, picking up the phones, sending out emails, etc. to try to understand a little bit more about each individual project (i.e. who’s involved, what the timeline looks like, etc.).

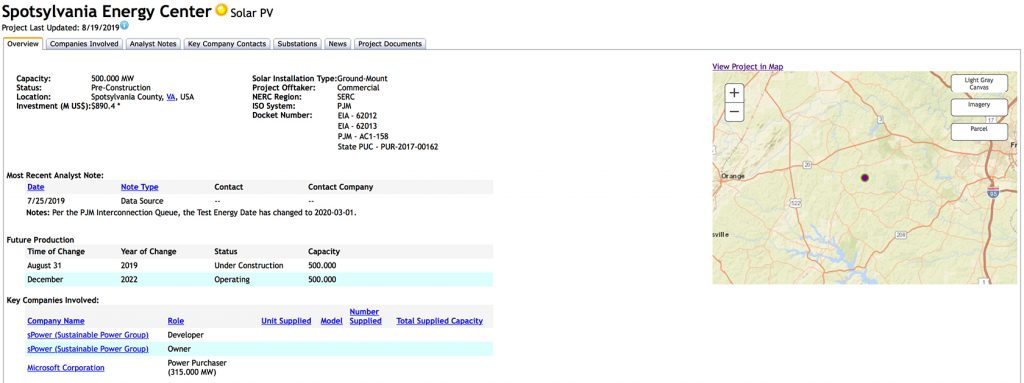

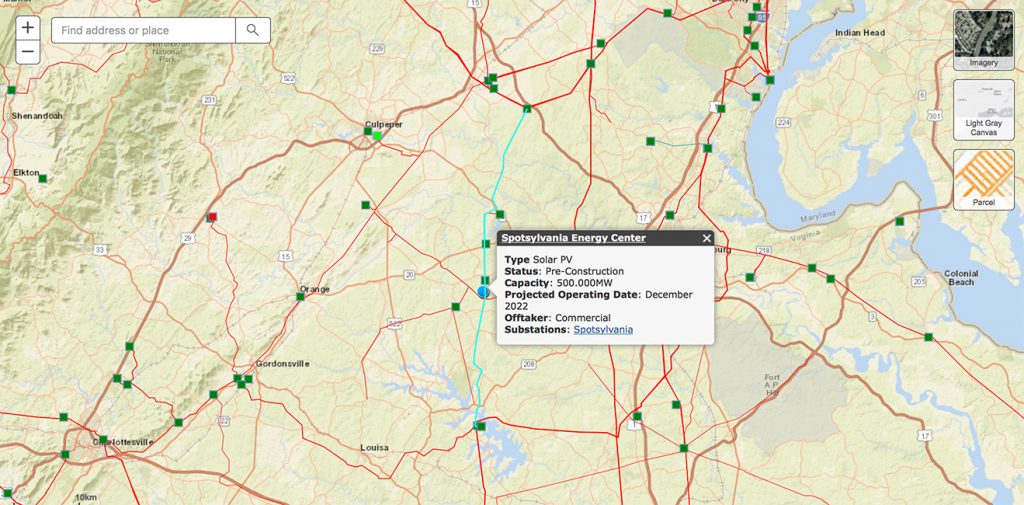

If we wanted to sort this out by the capacity, we’ll take a look at some of the larger projects that are going on in Virginia, all in pre-construction. We do have a pretty active territory down there. We’re looking at the… Spotsylvania Energy Center.

See Energy Acuity In Action

Solar Project Profile

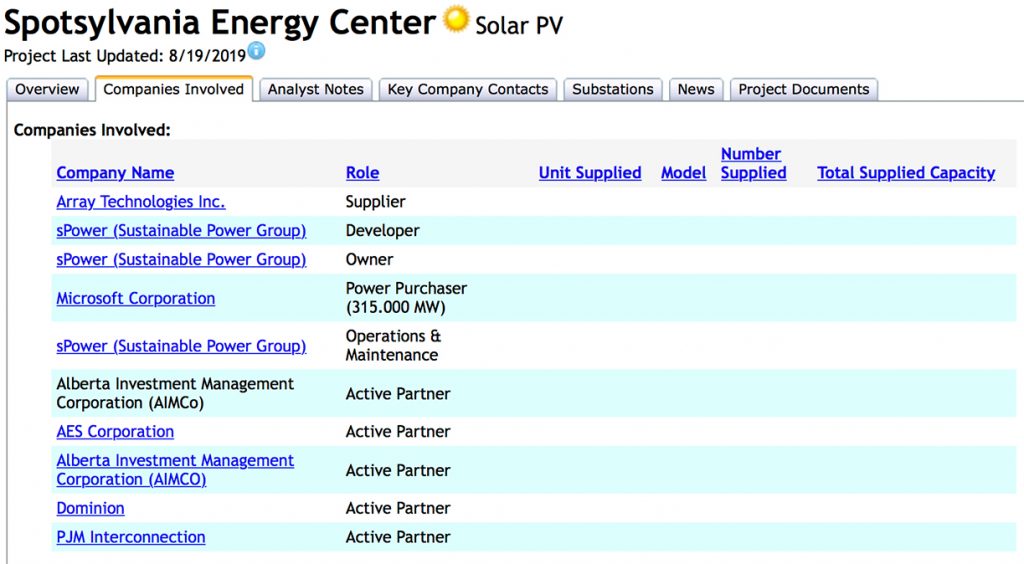

Looking into this project profile, we can understand a few more details about the actual project, including the estimated investment range, where it’s located, you can see it mapped out here on the right hand side, the project off-taker looks like a commercial PPA in place with Microsoft corporation, sPower as the project owner and developer and then you also have the future production timeline.

They are looking to go under-construction by the end of August and it’s mid-August 2019 right now, so our analyst team will then be responsible for making sure this data is still accurate when the time comes.

We go down and scroll through some of these tabs here, taking a look at some of the other companies involved.

Array is going to be the supplier, like we said, Microsoft being the power purchaser of 315MW, so this is a 500MW planned project, so it looks like there could be some room for another offtaker or perhaps partial merchant project here.

We do have some other companies involved (AES, AIMco & Dominion), listed as active partners right now. These are roles we can’t necessarily identify and confirm, but we do know in some way, shape or form, they are involved with this project.

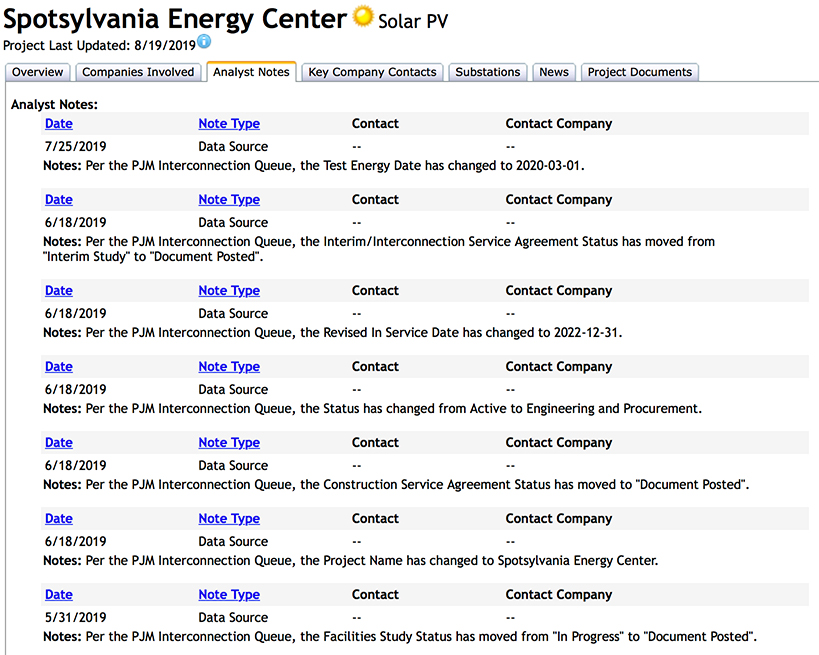

Analyst notes are going to be anything that we’ve dug up about this project, spanning all the way back to October of 2016 and have been updating the project, via the queue as well as some different varieties of data sources, up until July, 2019.

Key company contacts on these profiles will give you people that we’ve identified within the developer or project owner, as important people to speak to about the solar project and business development process.

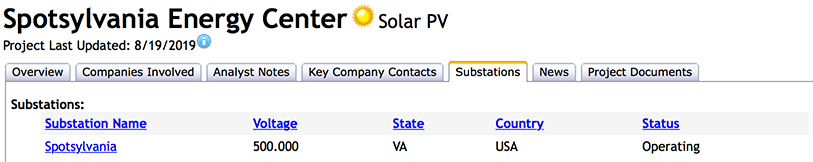

We’re also linking together the substations that this project is looking to get tied into, it happens to be the Spotsylvania substation, and it looks like their primary voltage is about 500 kV. If we click into that substation profile we also understand where it’s located.

It’s probably going to be pretty close to the solar project itself and it’s also going to have some ancillary details on when it went operating, if there’s a step-down voltage, maybe even a tertiary voltage.

Here, in this case, a secondary voltage being 115 kV as well as listing any other projects that are looking to get tied into this station.

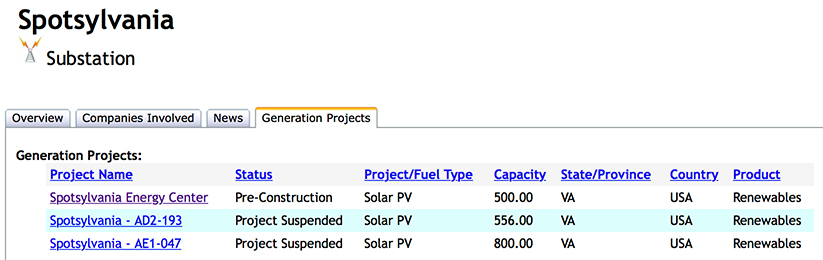

We go into the generation projects and we can understand, okay, there’s your Spotsylvania Energy Center in pre-construction, but there’s also two other Spotsylvania alphanumerical identifiers coming off the queue and listed as suspended projects.

So, we can get an understanding of who’s in line and give it a weight or a grade to each individual project based on who’s developing it and who’s interconnection queue filings went in first.

Back to the solar project though…

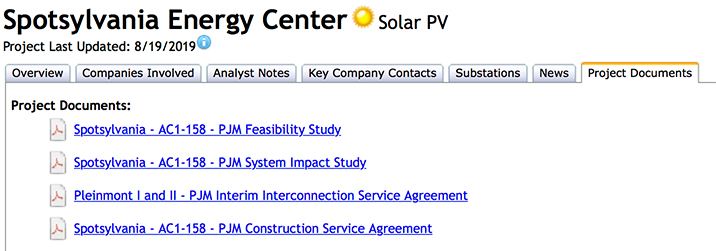

We’re also tracking news articles. Below is your publicly available information, again capturing these articles and then anything that is federally regulated.

Solar Project Analysis & Advanced Mapping

If we were to go back to the overview of this solar project, we can click right into the mapping feature. You can view the project in the map and then within our mapping feature you do have the ability to also get an understanding of the power delivery infrastructure in and around a project that you’re looking at.

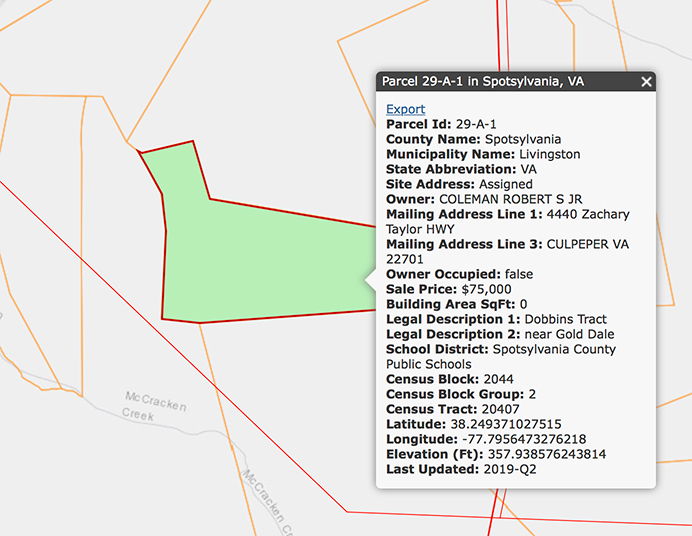

Perhaps you’re not the developer in this, but maybe you’re looking for a partial power purchase or maybe you’re looking to acquire this project at some point. You want to understand what other substations are around it, what other generation projects are around it (i.e. renewables or conventional power), storage projects that might be around, and if you wanted to expand on this; maybe you want to tie storage onto this actual project. We can also zoom in and overlay some parcel data here too.

Zooming into the project, I’ll put it over a light gray canvas so we can see all the different features a little more clearly. We’ll add in the transmission lines… add in substations… as mentioned we can also add different power generation projects in and around this area to get a good sense of the generation mix-up.

Let’s pretend that we’re a storage developer and we want to now see the possibility of adding an energy storage system onto this future project. Right now, it’s in pre-construction.

Below is your Spotsylvania Energy Center and you can take a look at some of these available land parcels around the actual project.

In general, we are collecting this information from the counties. Each county is reporting this information a little bit differently but you will get ownership information, market value, as well as different ancillary services; flood zones, lat/long, census info, etc. Once again, each parcel data is reported a little bit differently depending on what county you’re actually in. This is a really good way, both for acquisitions and greenfield developers, to find land and advantageous substation to tap into. This helps to understanding other land parcels around that substation, the power delivery infrastructure and the generation mix-up of the entire area.

Thanks Kurt and thank you all for joining us! If you need more information, please visit energyacuity.com, shoot us an email at sales@energyacuity.com or give us a call at 720-235-1296.

Demo Energy Acuity

Tell us a little about yourself, and we’ll show you why hundreds of companies trust Energy Acuity to provide Accurate & Granular Renewable Energy Intelligence.

Top 10 Renewable Energy Companies (2019)

Top 10 Renewable Energy Companies (2019)  — Solar & Wind

— Solar & Wind