Renewable energy tax credits are essential to early-stage and small developers. These tax credits allow developers to sell energy cheaper so they can compete with traditional energy sources, like coal and natural gas, because these developers get money on the back end in order to be profitable.

Not only do tax credits help make wind and solar energy more competitive, especially in the early stages—they provide a way for other companies to help fuel development by allowing them to partner with early-stage developers.

In this article, we’ll explore two major federal renewable energy tax credits for solar and wind developers in the United States: the Investment Tax Credit (ITC) and the Production Tax Credit (PTC).

The Solar Investment Tax Credit (ITC)

What It Is

The Solar ITC is “currently a 30 percent federal tax credit claimed against the tax liability of residential (Section 25D) and commercial and utility (Section 48) investors in solar energy property. The Section 25D residential ITC allows the homeowner to apply the credit to his/her personal income taxes. This credit is used when homeowners purchase solar systems outright and have them installed on their homes. In the case of the Section 48 credit, the business that installs develops and/or finances the project claims the credit.” (SEIA ITC Fact Sheet)

Who It Benefits

The Solar ITC is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government. This renewable energy tax credit benefits both individuals and companies.

Future Of The ITC

In December 2015, the ITC was extended. It will the drop in percentage using the following timeline:

- Through 2019, the residential and commercial ITCs are equal to 30% of the basis that is invested in eligible property which has commenced construction.

- In 2020, the ITC drops to 26%.

- In 2021, the ITC drops to 22%.

- After 2023, the residential credit will drop to 0%, and the commercial and utility credit will drop to a permanent 10%.

The bill will also allow owners who begin construction on projects before the end of 2021 to claim the larger credit once their project is placed in service, as long as that project is placed in service before the end of 2023. (Impacts of Solar Investment Tax Credit Extension)

According to SEIA, “the recent ITC extension is expected to nearly quadruple solar deployment by the end of 2020 while doubling US solar employment and spurring $140 billion in economy (sic) activity.”

The Renewable Energy Production Tax Credit (PTC)

What It Is

The PTC is “a federal incentive that provides financial support for the development of renewable energy facilities. Companies that generate electricity from wind, geothermal, and ‘closed-loop’ bioenergy (using dedicated energy crops) are eligible for a federal PTC, which provides a 2.3-cent per kilowatt-hour (kWh) incentive for the first ten years of a renewable energy facility’s operation.” (Production Tax Credit for Renewable Energy)

Who It Benefits

The PTC is a commercial tax credit.

Future Of The PTC

The tax credits, which have been extended through 2019, have begun phasing down by 20% each year beginning in 2017. Here are the details according to the AWEA:

- In 2015 and 2016, wind projects that started construction received a full-value PTC of 2.3 cents per kilowatt-hour.

- In 2017, the PTC drops to 80%.

- In 2018, the PTC drops to 60%.

- In 2019, the PTC drops to 40%.

As before, the rules will allow wind projects to qualify as long as they start construction before the end of the period.

According to the AWEA:

“…more than 18 gigawatts of wind power capacity are now under construction or in advanced development. With the PTC phasedown, wind energy can growing (sic) to supply 10 percent of U.S. electricity by 2020 and support tens of thousands (sic) additional well-paying jobs.”

Effects Of The PTC & ITC

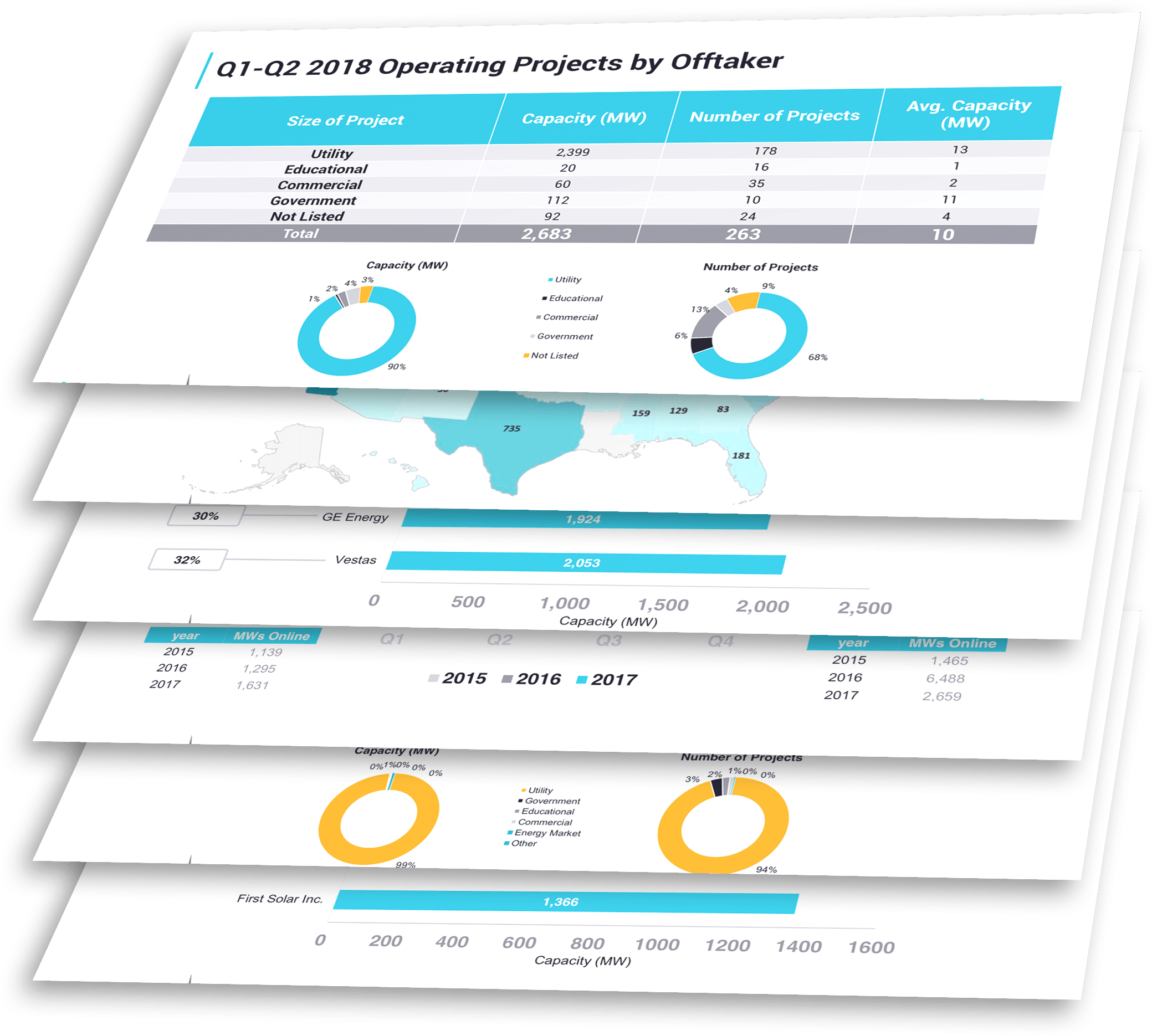

Wind

Solar

Conclusion

In the past, the PTC was always extended on a yearly basis, which made it difficult for companies to plan—there was a mad rush to complete projects in the fourth quarter of the year because developers didn’t know if tax credits would exist.

If the credit did get extended, developers would ramp up again—however, this was problematic for planning purposes. By knowing the future of the PTC and the ITC, developers can now plan development timelines over multiple years with the certainty of knowing the tax incentives will be in place when the projects begin operating.

Learn More

To find out more information about renewable energy projects and the tax credits that go along with them, check out the full version of our project profiles in the Energy Acuity Renewables Database.

Source: Energy Acuity

Need Detailed Renewable Energy Intelligence & Analysis? Request a Free Demo of the Energy Acuity Platform Today!

Energy Acuity (EA) is the leading provider of power generation and power delivery market intelligence. EA’s unique approach merges primary research, public resource aggregation, web monitoring and expert analysis that is delivered through a simple, dynamic online platform. This allows our clients to focus on actionable information and win business over the competition.